What is a Virtual Data Room?

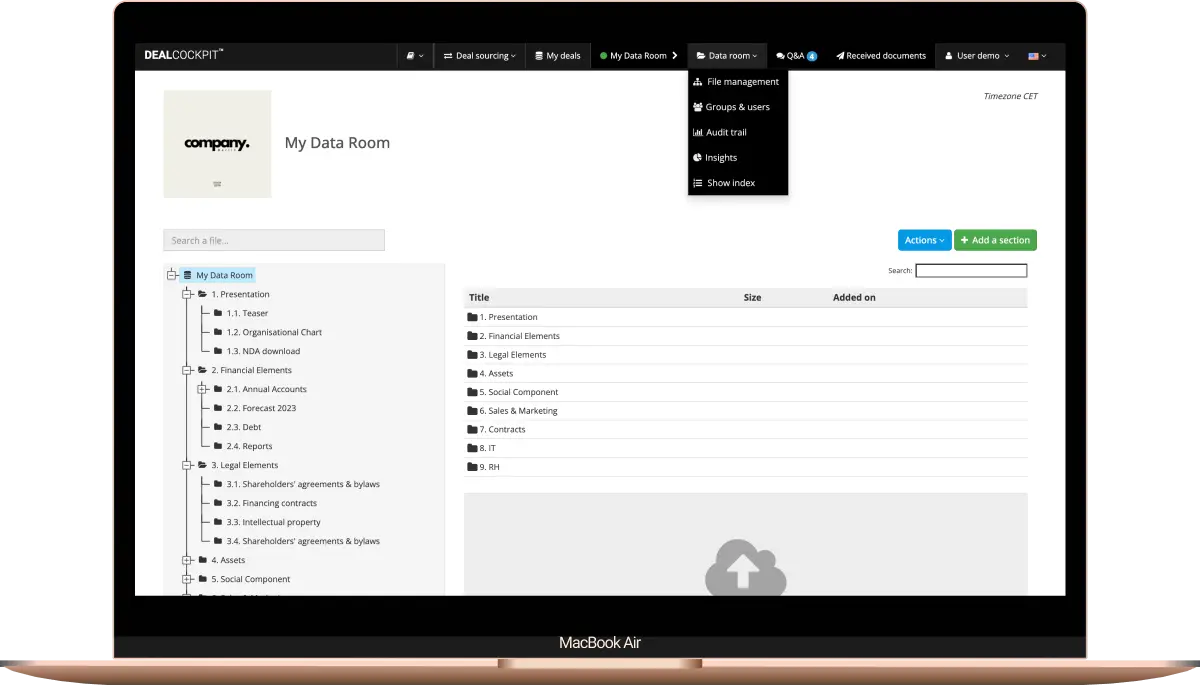

A virtual data room or VDR is a secure online space where companies store and share sensitive documents during transactions like M&A, fundraising, restructuring or even IPOs. It centralises files, controls who can access what, and tracks every interaction for maximum security and transparency.

Unlike generic file-sharing tools, a VDR offers encryption, strict permission settings, watermarking, and audit trails to protect confidential information. It helps teams collaborate efficiently, reduces risk, and speeds up due-diligence processes by giving potential buyers or investors, as well as advisors and their clients a single, organised place to review materials without compromising security.

Why use a data room?

Bring down overall cost

Using a data room reduces administrative overhead, travel, and document management costs. By digitising processes and centralising information, teams avoid duplication, inefficiencies, and delays. This streamlined workflow lowers total transaction expenses while improving visibility into ongoing deal activities.

Accelerate due diligence

Data rooms speed up due diligence by giving all parties instant, structured access to relevant documents. Smart indexing, search features, Q&A workflows, and consistent file organisation help stakeholders, potential buyers, and investors find what they need quickly, enabling smoother collaboration and shorter review cycles.

Protect sensitive information

Virtual data rooms secure confidential files with encryption, granular permissions, watermarking, and detailed activity logs. These controls ensure only authorised users access critical documents. By minimising leak risks and safeguarding compliance, a VDR provides a trusted environment for high-stakes transactions.

Centralise deal efforts

A VDR consolidates all deal-related documents, communication, and updates into one organised space. Teams stay aligned, avoid version confusion, and maintain full visibility throughout the process. It is a central hub that strengthens coordination across internal stakeholders, advisors, and potential investors or buyers.

Close faster

With streamlined document management, communication tools, and controlled access, data rooms eliminate bottlenecks that slow down decisions. Parties access the same information instantly, reducing back-and-forth and enabling quicker approvals. This clarity helps move deals from review to signature sooner.

Multiply your chances

A well-structured VDR signals professionalism, builds trust, and allows more investors or buyers to assess opportunities efficiently. Smooth access, clear organisation, and transparent activity tracking create a positive impression, increasing engagement and improving the likelihood of receiving stronger offers.

How to choose the best VDR provider?

Security

Efficiency

User-friendliness

Service

What transactions are data rooms used for?

Buy-Side M&A →

Optimise your external growth strategy by cutting back on labor-intensive review processes, accelerate due diligence, and simplify communication.

Sell-Side M&A →

Efficiently navigate the entire deal lifecycle: secure sensitive documents, attract more buyers, track activity, and seamlessly collaborate.

Private Equity →

Ensure compliance, streamline portfolio management, support exits and acquisitions, and stay in control during multi-party negotiations.

Fundraising →

Optimise your roadshow, impress investors, effortlessly manage investor access, and secure momentum through every funding round.

Restructuring & Insolvency →

Gain full control over sensitive information, ensure transparency and smooth communication between parties, and bring structure to high-stakes proceedings.

Companies →

Increase your chances: disposal, merger, external growth, asset reallocation, raising capital – run your operations smoothly, efficiently, and securely.

IPOs →

Stay ahead of regulatory scrutiny, control disclosure timelines, and keep your listing process on track – from pre-IPO to post-listing.

Investment Banks →

Accelerate the deal lifecycle, manage multiple projects, cut costs, and improve your clients’ ROI.

Virtual data rooms vs cloud sharing

Cloud Service

VDR

Data Storage & Sharing

User Management

Easy Document Upload

Multi-Factor Authentication

Activity Tracking

Granular Access Rights Management

NDA Integration

PDF Redaction

Live Watermark

Advanced User Insights

Q&A Module

Premium Support

✓

✓

✓

Limited

✗

✗

✗

✗

✗

Limited

✗

✗

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

✓

The right plan for your needs

DC Board for all your projects

Manage multiple projects in as many data roms as you need with DealCockpit™ Board.

DC Solo for once-off operations

A premium data room experience, tailor-made to any operation from disposal to external growth.

Ready when you are!

Need us to do the heavy lifting? Our experts will set up your data room for you.

They trust us

DealCockpit™ : Deal Stories

-

KUANTOM is adding two investment funds to its shaker!

Following LVMH's investment in 2019, the ‘Nespresso of cocktails’ is raising €5 million from Groupe SEB and SOCADIF Capital Investissement.

➔

-

Moret Industries welcomes a pool of investors led by Ocean Peak Capital

The industrial group is consolidating its equity capital to pursue its projects in manufacturing's environmental transition, with the arrival of a majority pool of investors led by Ocean Peak Capital.

➔

-

HEAD is joined by the Aqualung Group

Austrian sporting goods giant HEAD is acquiring French scuba diving pioneer, the Aqualung Group in this cross-border takeover.

➔

-

Accor is acquiring the prestigious Maison Dalloyau for €3.3 million

A new chapter is beginning for this French institution founded in 1682: a €15 million investment plan is planned to revive the Parisian luxury delicatessen brand.

➔

Resources

Consult helpful articles, client interviews & testimonies, FAQs, as well as our latest insights.